|

AGENDA R |

Council Meeting

TUESDAY 28 MARCH 2017

6:30pm

|

|

Council Meeting 28 March 2017 |

The following provides a summary of the items to be considered at the meeting.

Administrator's Minutes

Nil at the time of printing.

Staff Reports

ITEM PAGE #

C0317 Item 1 WestConnex Stage 1 (M4 East) draft addendum to Urban Design & Landscape Plan 11

C0317 Item 2 Minutes of the IAG Meeting held 9 March 2017 and Minutes of the LRAC Meeting held 14 March 2017 17

C0317 Item 3 ADOPTION OF AFFORDABLE HOUSING POLICY FOLLOWING PUBLIC EXHIBITION 23

C0317 Item 4 Addressing Domestic and Family Violence in the Inner West 224

C0317 Item 5 Council response to Draft Central District Plan 233

C0317 Item 6 Planning Proposal Request - 183 & 203 New Canterbury Road, Lewisham 242

C0317 Item 7 Draft State Environmental Planning Policy (SEPP) for Educational Establishments and Child Care Facilities 393

C0317 Item 8 Proposed amendments to Environmental Planning & Assessment Act 1979 475

C0317 Item 9 Statement of Vision and Priorities 484

C0317 Item 10 Homelessness Policy 508

C0317 Item 11 Proposed name of the new Marrickville Library site 528

C0317 Item 12 Local Traffic Committee Meeting held on 2 March 2017 533

C0317 Item 13 Inner West Council Investments as at 28 February 2017 556

Reports with Confidential Information

ITEM PAGE #

C0317 Item 14 Trial extension of the current swimming season at Fanny Durack Aquatic Centre.

|

|

Council Meeting 28 March 2017 |

|

INDEX |

1 Acknowledgement of Country

2 Period of Silence for Prayer, Pledge or Contemplation

3 Present

4 Apologies

5 Disclosures

of Interest (Section 451 of the Local Government Act

and Council’s Code of Conduct)

6 Confirmation of Minutes Page

Minutes of 28 February 2017 Council Meeting 4

7 Administrator's Minutes

8 Staff Reports

9 Reports with Confidential Information

Reports appearing in this section of the Business Paper are confidential in their entirety or contain confidential information in attachments.

The confidential information has been circulated separately.

|

|

Council Meeting 28 March 2017 |

Minutes of Ordinary Council Meeting

held at Ashfield Service Centre on 28 February 2017

Meeting commenced at 6:30pm

|

Present: |

|

|

Richard Pearson |

Administrator |

|

Rik Hart |

Interim General Manager |

|

Peter Gainsford |

Deputy General Manager Assets and Environment |

|

John Warburton |

Deputy General Manager Community and Engagement |

|

Michael Tzimoulas |

Deputy General Manager Chief Financial and Administration Officer |

|

Wal Petschler |

Group Manager Footpaths, Roads, Traffic and Stormwater |

|

Tanya Whitmarsh |

Group Manager Governance |

|

Gill Dawson |

Acting Group Manager Strategic Planning |

|

Popy Mourgelas |

Manager Corporate Governance, Ashfield |

|

Ian Naylor |

Manager Governance & Administration, Leichhardt |

|

Katerina Maros |

Governance Officer, Leichhardt (Minute Taker) |

Public Speakers: see last two pages of these minutes.

1. Acknowledgement of Country by Chairperson

· “I acknowledge the Gadigal and Wangal people of the Eora nation on whose country we are meeting today, and their elders past and present.”

2. Notice of Live Streaming of Council Meeting

The Administrator advised that the Council meeting was being streamed live on Council's website and members of the public must ensure their speech to the Council is respectful and use appropriate language.

3. Disclosures of Interests

The Administrator declared that he had no declarable interests in any matter listed on the business paper.

4. Confirmation of Minutes

|

The Administrator determined that the Minutes of the Council Meeting held on Tuesday, 6 December 2016 be confirmed. |

|

C0217 Item 17 Administrator's Minute: WestConnex Stage 3 (M4-M5 Link) construction dive-site options |

|

The Administrator determined that Council:

1. Calls on the NSW Government not to proceed with any further consideration of either of the mid-tunnel construction dive sites under consideration at 7 Darley Road and 29 Derbyshire Road, Leichhardt; 2. Calls on the Government to discontinue the process of seeking to establish a dive site in the densely populated Leichhardt/Lilyfield area; 3. Requests Council officers to further consider the suitability of the site at the western end of the Rozelle Rail Yards as a possible mid-tunnel construction dive site and report back to Council; 4. Calls on the State Government to ensure that the community and Council is fully consulted on any further consideration of dive site options in the Leichhardt area by the State Government; and 5. Calls on Sydney Motorway Corporation to immediately release information regarding the proposed Camperdown dive site and conduct an immediate Community Consultation Campaign.

|

|

C0217 Item 1 WestConnex Update Report |

|

The Administrator determined that Council:

1. Receives and notes the report; 2. Expresses concern about the demolition of Heritage Houses in Campbell Road (Bradfield Terrace listed on the State Heritage Register 2004) and 82 Campbell Street (Brickworker’s Cottage State Heritage Listing 2009); 3. Acknowledges the considerable disruption to residents’ lives by Sydney Motorway Corporation (SMC) works, road closures and use of local streets for parking and vehicle access; and 4. Informs local residents around Simpson Park about the future of the fig trees in Simpson Park which border onto the proposed Campbell Street widening.

|

|

C0217 Item 2 Post Exhibition Report: Marrickville Heritage Review |

|

The Administrator determined that Council defer report for further consideration of issues raised and report back to March 2017 Council Meeting.

|

|

C0217 Item 3 Planning Proposal - 168 Norton Street, Leichhardt |

|

The Administrator determined that: 1. The attached Planning Proposal be forwarded to the Minister for Planning for a Gateway determination in accordance with Section 56 of the Environmental Planning & Assessment Act 1979; 2. The Department of Planning and Environment be requested to delegate the plan making functions, in relation to the subject Planning Proposal, to Council; 3. Following receipt of a Gateway determination, and compliance with any conditions and following the required changes being made by the Proponent, the Planning Proposal and supporting documentation be placed on public exhibition for a minimum of 28 days and public authorities be consulted on the Planning Proposal in accordance with the Gateway determination; and 4. A report be presented to Council at the completion of the public exhibition period detailing submissions received and the outcome of consultation with public authorities.

|

|

C0217 Item 4 Annandale Conservation Area Extension |

|

The Administrator determined that:

1. The attached Planning Proposal be forwarded to the Minister for Planning for a Gateway Determination in accordance with Section 56 of the Environmental Planning & Assessment Act 1979; 2. The Department of Planning and Environment be requested to delegate the plan making functions, in relation to the subject Planning Proposal, to Council; 3. Following receipt of a Gateway Determination, and compliance with any conditions, the Planning Proposal and supporting documentation be placed on public exhibition for a minimum of 28 days and public authorities be consulted on the Planning Proposal in accordance with the Gateway Determination; and 4. A report be presented to Council at the completion of the public exhibition period detailing submissions received and the outcome of consultation with public authorities.

|

|

C0217 Item 5 Draft Marrickville Local Environmental Plan 2011 (Amendment No. X) - Change to the Land Use Table for the B7 Business Park Zone |

|

The Administrator determined that: 1. The report be received and noted; 2. Council resolves to prepare a Planning Proposal to amend MLEP 2011 to delete “shop top housing” as a permissible use within the B7 Business Park zone and nominate itself as the Relevant Planning Authority; 3. Council submits the draft Planning Proposal to the Department of Planning and Environment for Gateway determination; and 4. Council resolves to publicly exhibit the draft Planning Proposal.

|

|

C0217 Item 6 Marrickville Golf Course Lands and Dibble Avenue Waterhole - Plan of Management |

|

The Administrator determined that the preparation of a Plan of Management for the Marrickville golf course lands and Dibble Avenue Waterhole be prioritised and brought forward to commence in 2017.

|

|

C0217 Item 7 Minutes of the IAG Meeting held 9 February 2017 and LRAC Meeting held 14 February 2017 |

|

The Administrator determined that:

1. The Minutes of the IAG Meeting held on 9 February 2017 be noted. 2. The Minutes of the LRAC Meeting held on 14 February 2017 be noted.

|

|

C0217 Item 8 Local Traffic Committee Meeting held on 1 December 2016 and 2 February 2017 |

|

The Administrator determined that: 1. The Minutes of the Local Traffic Committee Meeting held on 1 December 2016 be received and noted. 2. The Minutes of the Local Traffic Committee Meeting held on 2nd February, 2017 be received and noted.

|

|

C0217 Item 9 ADDRESSING DOMESTIC AND FAMILY VIOLENCE IN THE INNER WEST |

|

The Administrator determined that Council defer report for further consideration of appropriate funding levels and report back to March 2017 Council Meeting.

|

|

C0217 Item 10 Quarter 2 Progress Report - IWC Operational Plan |

|

The Administrator determined that the report be received and noted.

|

|

C0217 Item 11 Flood Management Advisory Committee meeting held 1 February 2017 |

|

The Administrator determined that the minutes of the Inner West Council Flood Management Advisory Committee held on 1 February 2017 be received and the recommendations be adopted.

|

|

C0217 Item 12 Review of Planning Proposal Fees and Charges |

|

The Administrator determined that:

1. Under the provisions of the Local Government Act, Council amend the current Ashfield, Marrickville and Leichhardt fees for planning proposals and introduce an integrated Inner West Council planning proposal fee structure; and 2. Council exhibit the proposed fees and charges and receive a report on submissions received. |

Procedural Motion

The Administrator determined that Items 13 and 16 be considered in conjunction.

|

C0217 Item 13 Quarterly Budget Review Statement for the period ended 30 September 2016 |

|

The Administrator determined that:

1. The report be received and noted; and 2. Council approves the budget adjustments required.

|

|

C0217 Item 16 Quarterly Budget Review Statement for the period ended 31 December 2016 |

|

The Administrator determined that:

1. The report be received and noted; and 2. Council approves the budget adjustments required.

|

|

C0217 Item 14 Inner West Council Investments as for the periods ending 30 November 2016, 31 December 2016 and 31 January 2017 |

|

The Administrator determined that the report be received and noted.

|

|

C0217 Item 15 Disclosures of Interest by Designated Persons |

|

The Administrator determined that the report be received and noted.

|

Meeting closed at 9:52pm.

Public Speakers

|

Item 1: |

Frank Breen, Leichhardt LRAC |

Balmain |

|

|

Frank Smith |

St Peters |

|

|

Chris Woods, Marrickville LRAC |

Marrickville |

|

|

John Stamolis, Leichhardt LRAC |

Balmain |

|

|

Linda Kelly, Leichhardt LRAC |

Leichhardt |

|

|

|

|

|

Item 2: |

Joseph Bell |

Ashfield |

|

|

Bruce Woolf |

Sydney |

|

|

Van Luan Nguyen |

Tempe |

|

|

Adam Sives |

Marrickville |

|

|

Kevin Lam |

St Peters |

|

|

James Cartwright |

Rhodes |

|

|

Victor Macri, Marrickville LRAC |

Marrickville |

|

|

Peter Tanvakeras |

Marrickville |

|

|

|

|

|

Item 3: |

Linda Kelly, Leichhardt LRAC |

Leichhardt |

|

|

Darcy Byrne, Leichhardt LRAC |

Leichhardt |

|

|

|

|

|

Item 6: |

Mark Krupinski |

Marrickville |

|

|

Justine Langford |

Marrickville |

|

|

James Gilronan |

Dulwich Hill |

|

|

|

|

|

Item 7: |

John Stamolis, Leichhardt LRAC |

Balmain |

|

|

|

|

|

Item 8: |

John Caley |

Newtown |

|

|

Justin Hillis |

Marrickville |

|

|

James Gilronan |

Dulwich Hill |

|

|

Alex Lofts, Ashfield LRAC |

Summer Hill |

|

|

Renee Holmes |

Ashfield |

|

|

|

|

|

Item 9 |

Linda Kelly, Leichhardt LRAC |

Leichhardt |

|

|

John Stamolis, Leichhardt LRAC |

Balmain |

|

|

Darcy Byrne, Leichhardt LRAC |

Leichhardt |

|

|

|

|

|

Item 11: |

Frank Breen, Leichhardt LRAC |

Balmain |

|

|

|

|

|

Item 12: |

John Stamolis, Leichhardt LRAC |

Balmain |

|

|

|

|

|

Item 13: |

Mark Drury, Ashfield LRAC |

Ashfield |

|

|

Frank Breen, Leichhardt LRAC |

Balmain |

|

|

John Stamolis, Leichhardt LRAC |

Balmain |

|

|

Darcy Byrne, Leichhardt LRAC |

Leichhardt |

|

|

|

|

|

Item 14: |

Frank Breen, Leichhardt LRAC |

Balmain |

|

|

James Gilronan |

Dulwich Hill |

|

|

|

|

|

Item 16: |

Mark Drury, Ashfield LRAC |

Ashfield |

|

|

Frank Breen, Leichhardt LRAC |

Balmain |

|

|

John Stamolis, Leichhardt LRAC |

Balmain |

|

|

Darcy Byrne, Leichhardt LRAC |

Leichhardt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 17: |

Catherine Gemmell |

Leichhardt |

|

|

Christina Valentine |

Leichhardt |

|

|

Ted Cassidy, Ashfield LRAC |

Haberfield |

|

|

Alex Lofts, Ashfield LRAC |

Summer Hill |

|

|

Lesley Treleavan |

Camperdown |

|

|

Darcy Byrne, Leichhardt LRAC |

Leichhardt |

|

|

John Lozano |

Haberfield |

|

|

Council Meeting 28 March 2017 |

Subject: WestConnex Stage 1 (M4 East) draft addendum to Urban Design & Landscape Plan

File Ref: 1517-01/22610.17

Prepared By: Kendall Banfield - Manager WestConnex Unit

Authorised By: John Warburton - Deputy General Manager Community and Engagement

|

SUMMARY WestConnex proponent Sydney Motorway Corporation (SMC) has placed a draft addendum to the M4 East Urban Design and Landscape Plan (UDLP) on public exhibition from 22 February to 22 March 2017. The draft addendum essentially adds design detail to the proposed ventilation facility and perimeter wall at the M4 East Parramatta Road / Walker Street construction compound. At the time of finalising this report, Council officers are preparing a submission, to be lodged with SMC by the due date. Key issues raised in Council’s October 2016 submission on the initial draft M4 East UDLP are summarised in this report, as are key comments to be raised in the forthcoming submission on the draft addendum. This report recommends that and forwards to SMC any comments additional to those discussed in this report as a late addendum to Council’s submission. |

|

THAT Council:

1. Receives and notes this report; and

2. Forwards to Sydney Motorway Corporation any comments additional to those discussed in this report as a late addendum to Council’s submission. |

BACKGROUND

WestConnex proponent Sydney Motorway Corporation (SMC) - as delegate to Roads & Maritime Services (RMS) - has placed a draft addendum to the M4 East Urban Design & Landscape Plan (UDLP) on public exhibition from 22 February to 22 March 2017. The draft addendum is an update of Sections 5.3 Ventilation Facility at Underwood Road and 5.7 Ventilation Facility at Parramatta Road of the draft UDLP that was initially exhibited in September and October 2016. This report only considers the Section 5.7 Parramatta Road, as the Underwood Road section (5.3) relates to Homebush within the Strathfield Local Government Area. The M4 East UDLP has been prepared in accordance with Consent Condition B45, guided by an Urban Design Review Panel established according to Consent Condition B44. Council staff have participated in Urban Design Review Panel meetings late 2016 and early 2017. Staff have also participated in meetings for the related M4 East Legacy Projects during this time. The draft addendum is largely concerned with design details for the proposed ventilation facility and perimeter wall at the Parramatta Road / Walker Street construction compound at Haberfield. Photomontages of these proposed structures, taken from the draft addendum document, are at ATTACHMENT 1.

At its October 2016 meeting, Council had considered a report, with Council officers’ submission attached, on the draft UDLP. Council resolved to receive and note the report and to forward to SMC an additional comment about lack of landscaped or other buffering against construction and operational traffic noise for dwellings at 14 to 24 Wattle Street, Haberfield. This comment was forwarded to SMC soon after the Council meeting, and the Wattle Street matter has been since raised by staff at project meetings. A summary of points raised in Council’s October 2016 submission on the UDLP is as follows:

· residual open space along the WestConnex corridor should be designed to be place-based and include distinctive elements that relate to the historic character of Haberfield and Ashfield;

· in order to achieve an appropriate place-based design, it is necessary for SMC to seek input on designs from Council staff, consultants and community groups (such as the Haberfield Association) with expertise on Haberfield’s historic character;

· there is a lack of design detail in the draft UDLP for the non-roadway parts of the M4 East;

· the UDLP does not outline how SMC has responded to landscape and urban design issues raised in former Ashfield Council’s October 2015 submission on the M4 East Environmental Impact Statement (EIS);

· there is a lack of detail on how the prominent structures (mainly the wall and ventilation facility) will be visually integrated into the Haberfield urban fabric;

· there is no information about how salvaged materials can be integrated into public domain treatments;

· pedestrian crossing distances across Parramatta Road and Wattle Street are excessive and there is lack of information about integration of bus stops on Parramatta Road; and

· there is a need for an overall ‘interpretation plan’ and a further public exhibition of design details.

At the time of writing, Council officers are preparing a submission on the draft addendum to the M4 East UDLP, to be lodged with SMC by the due date. Draft advice from Council’s Strategic Planner is at ATTACHMENT 2, with advice from Council’s Heritage Advisor also to be included in the submission. At this stage, Council officers believe the design details in the draft addendum represent appropriate treatments that address most of the abovelisted issues raised in Council’s October 2016 submission. Staff however remain concerned about the height, and consequently the visual impact, of the proposed perimeter wall and ventilation facility. Staff are also concerned that the issue raised previously about lack of landscaped or other buffering against construction and operational traffic noise for dwellings at 14 to 24 Wattle Street, Haberfield has not been resolved. These matters will be raised in Council’s submission. A summary of Council’s submission will be reported through the WestConnex Weekly Update Report and other information channels. Through these channels, Council has been encouraging community members to make a submission. The document and an online submission form are available at: www.westconnex.com.au/provide-feedback-draft-addendum-m4-east-urban-design-and-landscape-plan

FINANCIAL IMPLICATIONS

Nil

OTHER STAFF COMMENTS

Nil, but Council’s Strategic Project Planner and Heritage Advisor are currently involved in the drafting of Council’s submission, to be lodged by the 22 March 2017 deadline.

PUBLIC CONSULTATION

Nil. This report responds to public consultation undertaken by the WestConnex proponent. Council is an external stakeholder and there is no need or requirement for Council to undertake consultation additional to that undertaken by the proponent.

|

1.⇩ |

Photomontages from draft addendum to M4 East UDLP showing proposed Parramatta Road ventilation facility and perimeter wall, Haberfield |

|

2.⇩ |

Draft comments on draft addendum to M4 East UDLP from Council's Strategic Planner |

|

Council Meeting 28 March 2017 |

Subject: Minutes of the IAG Meeting held 9 March 2017 and Minutes of the LRAC Meeting held 14 March 2017

File Ref: 17/4718/27903.17

Prepared By: Katerina Maros - Governance Officer

Authorised By: Tanya Whitmarsh - Group Manager Governance

|

SUMMARY To present the Minutes of the IAG Meeting held on 9 March 2017 and the LRAC meeting held 14 March 2017. |

|

RECOMMENDATION

THAT:

1. The Minutes of the IAG Meeting held on 9 March 2017 be noted. 2. The Minutes of the LRAC Meeting held on 14 March 2017 be noted. |

BACKGROUND

The Implementation Advisory Group Meeting was held on 9 March 2017. The minutes of the meeting are shown as Attachment 1.

The Local Representation Advisory Committee Meeting was held on 14 March 2017. The minutes of the meeting are shown as Attachment 2.

FINANCIAL IMPLICATIONS

Nil.

OTHER STAFF COMMENTS

Nil.

PUBLIC CONSULTATION

Nil.

CONCLUSION

Nil.

|

1.⇩ |

IAG Minutes - 9 March 2017 |

|

2.⇩ |

LRAC Minutes - 14 March 2017 |

|

Council Meeting 28 March 2017 |

Subject: ADOPTION OF AFFORDABLE HOUSING POLICY FOLLOWING PUBLIC EXHIBITION

File Ref: 16/5981/27554.17

Prepared By: Jon Atkins - Affordable Housing Officer

Authorised By: Erla Ronan - Group Manager Community Services and Culture

|

SUMMARY It is now widely recognised that there is a major shortfall of affordable housing in most cities and many regional and rural communities across Australia. The Inner West Council local government area (LGA) is no exception in this regard. It is also suffering from a shortfall of affordable housing. Research commissioned by Council reveals a large, disproportionate and growing number of local people in housing stress. This research shows that the market is not providing affordable housing for the vast majority of very low, low and moderate income households in the LGA. Nor is the market replacing existing housing stock lost through gentrification and redevelopment that is affordable to these groups.

These findings provide clear justification for the Inner West Council to actively seek to increase the supply of affordable housing through its planning instruments and policies. Not only is this in keeping with Council’s legislative obligations e.g. Object 5(a)(viii) of the Environmental Planning and Assessment Act 1979 (NSW) relating to ‘the maintenance and provision of affordable housing’, but it is also in accordance with the former councils’ affordable housing policies and strategies. In order to contribute to the goal of achieving an increase in affordability for the target groups identified in the Policy, the strategy recommends stronger intervention through the planning system in the form of mechanisms to capture an equitable share of land value uplift, together with mandatory contributions or inclusionary zoning in larger development sites within the LGA and in major State redevelopment projects.

This report presents the feedback and submissions received by Council during the public exhibition period and recommends that Council adopts the Affordable Housing Policy and the Position Paper: Best Practice in Value Capture as provided in ATTACHMENT 1 and ATTACHMENT 2. |

|

THAT Council:

1. Adopts the Affordable Housing Policy and the Position Paper: Best Practice in Value Capture; and 2. Submits the following recommended notice of motion to the National General Assembly (NGA) of Local Government (18-21 June 2017) to be held in Canberra, namely that the Federal Government give urgent consideration to measures to improve housing affordability in areas effected by high levels of housing stress such as Sydney's Inner West, including taxation and other non-supply side mechanisms that are currently inadequately utilised in initiatives to improve housing affordability. |

BACKGROUND

In early 2016 it was evident that State urban renewal projects, together with major planning proposals within the Inner West LGA, had the capacity to generate affordable housing on a reasonably significant scale through inclusionary zoning measures. Given the development pipeline, combined with the imperative for Council to lobby (a) the State government with respect to proposed urban renewal projects and (b) the Greater Sydney Commission during its preparation of the draft District Plans at the time, it was considered urgent to develop an affordable housing policy based upon a credible evidence base.

Consequently Judith Stubbs and Associates were commissioned to prepare an Affordable Housing Policy for Inner West Council. A Background Paper (ATTACHMENT 3) and a Position Paper on Best Practice in Value Capture were produced to provide a land value capture model and evidence base for the Policy. While originally focused on the former LGA of Marrickville, following the amalgamation on 12 May 2016, the research was extended to include data and modelling from the former LGAs of Ashfield and Leichhardt.

DISCUSSION

Key findings of the research underpinning the Policy include the following:

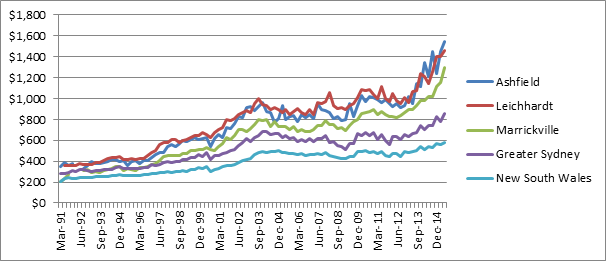

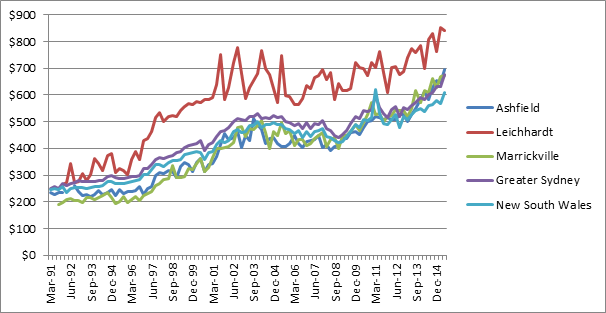

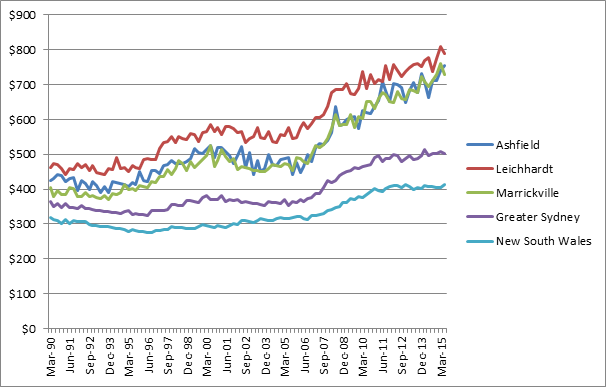

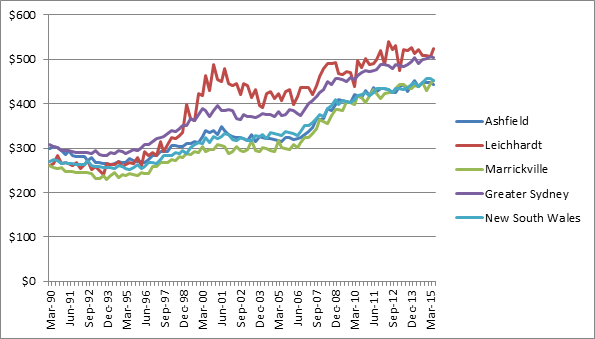

· The Inner West LGA has experienced some of the most rapid real increases in housing prices (rental and purchase) over the past decade, with accelerating trends in recent years. Even the lowest priced strata dwellings are no longer affordable to very low and low income households, and are generally affordable only to the upper end of the moderate income band.

· This is leading to serious impacts on the social and economic fabric of the local community:

o A large, disproportionate and growing number of local people are in housing stress, and sacrificing basic necessities to pay for their housing costs;

o There is a considerable displacement of historical populations through ongoing gentrification and non-replacement of affordable and lower cost housing; and

o There are very high current and projected levels of unmet need for affordable housing for low income emergency and service sector workers, as well as for more vulnerable groups such as aged pensioners and people with a disability.

The socio-economic research strongly indicates that virtually no new housing constructed in the future will be affordable to any very low or low income households, or to moderate income families, without strong intervention through the planning system to capture a reasonable share of land value uplift. Importantly, the economic modelling indicates that there will be significant land value uplift associated with rezoning across the LGA, particularly in larger brownfield sites and State urban renewal projects. Capturing a share of land value uplift before rezoning occurs is reasonable and feasible. It is important to stress that this is not a tax. Rather, it is a mechanism for capturing a reasonable share of the unearned increment in land value uplift created through the planning actions of councils and the State government.

The Policy contends that such value can be captured through voluntary planning agreements negotiated prior to rezoning (voluntary contributions) or through State Government allowing Council to be included under the provisions of State Environmental Policy No 70 (Affordable Housing) (mandatory contributions). Each of these mechanisms is addressed in the Policy. Feasible levels of benefit capture in relation to variations to height and floor space ratio (FSR) are also included in the Policy. The Policy also acknowledges that proposals to amend or exceed planning controls under a planning agreement will need to demonstrate that they have merit in their own right, prior to considering any contribution for a public purpose including affordable housing. As well, the evidence base for the Policy indicates that the implementation of value capture through the method of calculation recommended will not adversely impact on development feasibility and takes into account normal development profit margins.

AFFORDABLE HOUSING TARGETS

It is important to emphasise that a primary objective of the Policy is to determine feasible affordable housing contributions in relation to redevelopment costs across the local government area. Recommending certain density levels by postcode was not part of the Policy’s purpose. Rather it is Council’s existing LEPs associated with the former councils of Ashfield, Marrickville and Leichhardt that set out both the aims of local environmental planning provisions for land as well as the kinds of redevelopment and densities permitted within the LGA. In addition, variations to existing planning controls is a matter for Council to determine in keeping with local environmental planning provisions and identified local heritage values.

In keeping with this primary objective, the Policy establishes that Mandatory Affordable Housing Contributions will apply in the case of a proposed rezoning or amendment to planning controls that Council determines will allow for additional density within a site or precinct. Mandatory contributions will apply to all new release areas, brownfield and infill sites, and major private and public redevelopments, including on State government land and in State urban renewal precincts, including zones within the Parramatta Road Urban Transformation Strategy and the Sydenham to Bankstown Urban Renewal Corridor that fall within Council’s boundaries. With respect to Mandatory Affordable Housing Contributions, Council’s share of land value uplift will be taken as 15% of Gross Floor Area, both residential and commercial, of the development for development projects with a Gross Floor Area of 1,700sqm or greater, or where a development results in 20 or more dwellings. The rate of contributions reflects the relatively high land value uplift associated with inner city renewal areas amid rapid gentrification.

In addition, Council has determined that the Bays Precinct will be subject to a 30% Affordable Housing Contribution, subject to further feasibility analysis. (Refer to pages 11, 12, 17 and 18 of the Policy).

EXHIBITION PERIOD AND PUBLIC SUBMISSIONS

The exhibition period for the Affordable Housing Policy started on 11 December 2016 and ended on 13 February 2017. A total of 29 submissions were received during the exhibition period. An additional four submissions were received up until 14 March 2017. Of all 33 submissions received, 79% supported the Policy while 21% did not support the Policy.

Council thanks all individuals, groups and stakeholders who lodged submissions on the Policy. A wide range of constructive views, queries and recommendations were received and these have been considered during the preparation of the Policy’s final draft.

RESPONSES TO PUBLIC SUBMISSIONS

The document Report on Public Submissions (ATTACHMENT 4) provides responses to observations, concerns and recommendations contained in the 33 submissions. Separate submissions and attachments submitted to Council are at ATTACHMENT 5. Below is a sample of these key observations, concerns and recommendations:

|

Supportive of the Policy (79%) |

Not Supportive of the Policy (21%) |

|

“This is an essential policy for Council.” |

“There needs to be a clearer definition and evidence of hardship” |

|

“There is a need for diversity in a healthy, ethical and vibrant community.” |

By “mentioning 6 and 14 storeys … in the Haberfield, it is an acknowledgement that such (developments) might be permitted”. |

|

The Policy “is highly relevant for the rapid price escalations taking place in both the housing purchase and rental markets across the inner west.” |

“The real issue is declining home ownership rates which this policy fails to address.” |

|

“I support the affordable housing targets but would like to see them even higher.” |

“The council’s proposed affordable housing targets should be reduced and not exceed the recommended 5-10 percent target.” |

|

“Council needs a commitment to provide affordable housing. Notably to single parents who work in the local area.” |

The Policy “considers Redfern-type 14-storey towers for places like Dulwich Hill which is entirely out of character and inappropriate.” |

|

The policy “is too narrow in that adopts no position on the taxation system” e.g “capital gains taxation and the removal of subsidies such as negative gearing.” |

“If Council is to truly represent the views of residents, consultation on issues of such importance must be authentic.” |

|

“(W)ell designed affordable housing and plenty of green space is essential if our community is to thrive.” |

“Council should be lobbying the State and Federal governments to undertake other measures to ensure affordable housing and discourage the speculative property investment which is leading to unchecked population growth.” |

|

The Policy contributes “to a socially richer and more diverse community, as well as maintaining housing opportunities for vulnerable groups and workers in essential/community sectors.” |

“If the 15% target is adopted, then by the council's own words, there is only one known urban form outcome for the suburb - 14 storey towers in current low density streets. We consider any affordable housing benefits gained from this outcome to be significantly outweighed by the permanent destruction of the area's history, character and community.” |

|

The Policy “should apply for medium and small developments also.” |

“(T)he council could lobby government to extend its powers and the scope of this policy in regard to existing housing.” |

|

“I support, but am also conscious of young families like my own, who desire to remain in the area, but not in a unit, rather a home.” |

“Overall, the draft policy adopts only supply-side policies to support housing affordability, but not policies to reduce demand or change broader policy settings.” |

|

“We need options and affordable decent places to keep this area vibrant and liveable and retain sense of community.” |

The “policy will be counterproductive in the supply of affordable housing. It will be a burden on developers and land owners for the reasons stated and will inevitably lead to a loss of employment generating land.” |

|

The Policy requires “a clearer outline of its affordable housing targets.” |

|

|

“The Federation is pleased to see that the IWC focus on measures to increase the supply of affordable rental housing, have recognised the need to include essential workers on moderate incomes in the households who should be assisted and have underpinned their policy by sound research.” |

|

SUPPLEMENTARY STRATEGIES AND ACTIONS

On 6 December 2016, Council passed a resolution endorsing the draft Affordable Housing Policy and the Position Paper: Best Practice in Value Capture. Item 7 of this resolution commits Council to preparing a “5-10 year housing action plan to implement the Affordable Housing Policy (AHP) based on the Policy’s background data and Best Practice in Value Capture position paper, and drawing on existing Council research and plans.” Leichhardt Council’s Housing Action Plan 2016 -2025 forms an essential part of existing research and plans. ATTACHMENT 6 Supplementary Strategies and Actions provides an assessment of all actions contained in former Leichhardt Council’s Housing Action Plan.

FINANCIAL IMPLICATIONS

(1) The current Affordable Housing Officer (AHO) was employed on a temporary basis by Marrickville Council for two days a week for a two year period. The amalgamation has resulted in a considerable expansion of this officer’s workload as the position’s responsibilities for policy and program development related to affordable housing, boarding houses, management of Council’s affordable housing units and homelessness now covers the Inner West Council LGA. Likewise the proposed 5-10 year Housing Action Plan will require extra resources to implement. The AHO is responsible for the management of Council’s Affordable Rental Housing Program, which will expand in the future.

(2) On 6 December, 2016 Council adopted the following resolution (item 11):

That Council “allocates funds to undertake an integrated communication strategy to promote the Affordable Housing Policy, including the organisation of a community forum in 2017”. The allocation of funds for this strategy has yet to be determined.

OTHER STAFF COMMENTS

The development of this Policy has involved ongoing consultation and input from a range of staff across the Inner West Council.

PUBLIC CONSULTATION

The public were invited to make submissions on the Policy via Council’s online submissions form during the public exhibition period. Along with this form, access to the three documents comprising the Policy as well as an outline of the Policy’s rationale were made available on Council’s ‘Have Your Say’ webpage. During the exhibition period, the webpage received a total of 676 visits while document downloads totalled 300. A media release about the Policy being on public exhibition was issued on 16 December 2016. Council also advertised the exhibition period in its eNews editions between December 2016 and February 2017. A presentation on the Policy was made by consultant, Dr Judith Stubbs, to a Joint Local Representation Advisory Committee (LRAC) meeting on 20 September 2016. Various inquiries about the Policy from residents, developers and stakeholders were also responded to by the Affordable Housing Officer and Council’s Consultant during and after the public exhibition period.

CONCLUSION

As indicated above, the substantial evidence showing a growing number of local people in housing stress together with current and projected levels of unmet need for affordable housing, provides a significant evidence base to justify Council actively seeking an increase in the supply of affordable housing. The Affordable Housing Policy’s support for stronger interventions in the form of value capture, inclusionary zoning and development partnerships, offers Council the best means of increasing housing affordability for very low to moderate income households in the community.

|

1.⇩ |

Attachment 1 Inner West Council Affordable Housing Policy 16032017 |

|

2.⇩ |

Attachment 2 Best Practice in Value Capture 20161125 |

|

3.⇩ |

Attachment 3 Background Paper Affordable Housing Policy 20161125 |

|

4.⇩ |

Attachment 4 Report on Public Submissions |

|

5.⇩ |

Attachment 5 Attachments to Public Submissions Received |

|

6.⇩ |

Attachment 6 Supplementary Strategies and Actions |

|

|

Council Meeting 28 March 2017 |

Prepared for Inner West Council by Judith Stubbs and Associates

Published by Inner West Council

Email: council@innerwest.nsw.gov.au

http://www.innerwest.nsw.gov.au/

Copyright © Inner West Council 2017

ALL RIGHTS RESERVED

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form by any means electronic, mechanical, photocopying, recording or otherwise without the prior consent of the publishers.

Table of Contents

Contents

1..... PART A: Rationale for Use of Strong Planning Intervention to Create Affordable Housing

1.1 Overview

1.2..... What is Affordable Housing?

1.3..... Why does affordable housing matter?

1.4..... Gentrification and Social Exclusion

1.5..... Current Lack of Affordable Housing

1.6..... Likely Future Lack of Housing Affordability

1.7..... Rationale for Capturing Land Value Increment through Relevant Planning Mechanisms

1.8..... Key Considerations in Land Value Capture

1.9..... Council’s Obligations, Opportunities and Constraints under Relevant Legislation

1.10... Reasonableness and Feasibility of Mechanisms

2..... PART B: HOUSING POLICY

2.1 Housing Goal

2.2..... Affordable Housing Definition

2.3 Target Groups 15

2.4 Priority Strategies

2.5..... Pursue Planning Controls that Support Existing and New Supplies of Affordable Housing

2.6..... Partnerships to Increase Affordable Housing

2.7..... SEPP Affordable Rental Housing

2.8..... Research and Monitoring

2.9..... Key Performance Indicators

2.10 Administration

Appendix A: Marginal Uplift from Increased Height and/or Density

Overview

Modelling (Additional Saleable Floor Area)

1 PART A: Rationale for Use of Strong Planning Intervention to Create Affordable Housing

1.1 Overview

Part A of this document sets out background information that provides a context to Council’s Affordable Housing Policy, set out in Part B below. It sets out a definition and benchmarks for affordable housing in accordance with relevant legislation, and summarises research and analysis from JSA’s (2016) Affordable Housing Background Paper, which provide a clear rationale for this policy. The reader is also referred to JSA’s (2016) Position Paper: Best Practice in Value Capture for further rational. The Policy is also informed by the former Marrickville Council’s (2015) Marrickville Housing Profile, and the former Leichhardt Council’s (2011) Affordable Housing Strategy, and Strategic Action Plan.

The evidence indicates that there is clear justification for Inner West Council to actively seek to increase the supply of affordable housing through its planning instruments and policies. This is related to the large, disproportionate and growing number of local people in housing stress; the displacement of historical populations through ongoing gentrification and non-replacement of affordable housing lost; current and projected levels of unmet need for affordable housing including for key workers and more vulnerable groups; and the amount of unearned land increment (land value uplift) created through the operation of Council’s planning and approvals processes, some of which may reasonably be contributed to affordable housing as key infrastructure or a public purpose under a voluntary planning agreement or other legal mechanism.

Due to the failure of the market to provide affordable housing for very low and low income households, and for many moderate income households, this Policy principally focuses on strong interventions through the planning system and the direct creation of affordable housing on public land through development and management partnerships as these are virtually the only way to create affordable housing in most areas of Inner West Council area.

Council notes that proposals to amend or exceed planning controls under a planning agreement will need to demonstrate that they have merit in their own right, prior to considering any contribution for a public purpose including affordable housing.

1.2 What is Affordable Housing?

Housing is generally considered to be ‘affordable’ when households that are renting or purchasing are able to meet their housing costs and still have sufficient income to pay for other basic needs such as food, clothing, transport, medical care and education.

‘Affordable housing’ has a statutory definition under the NSW Environmental Planning and Assessment Act 1979 (NSW), being housing for very low, low or moderate income households, where ‘very low-income’ households as those on less than 50% of median household income; ‘low-income’ households’ as those on 50-80% of median household income, and ‘moderate-income’ households as those on 80-120% of median household income for Sydney SD.[1]

As a commonly used rule of thumb, housing is considered to be affordable where households pay no more than 30% of their gross household income on their rent or mortgage payments. This is often regarded as the point at which such households are at risk of having insufficient income to meet other living costs, and deemed to be in ‘housing stress’. Those paying more than 50% of gross income are regarded as being in ‘severe housing stress’.

The following table provides benchmarks that are used in this policy when referring to ‘affordable housing’, in 2016 dollars, and are consistent with relevant NSW legislation. These vales should be indexed quarterly.

· Table 1.1: Affordable Housing Income and Cost Benchmarks

|

|

Very low-income household |

Low-income household |

Moderate-income household |

|

Income Benchmark |

<50% of Gross Median H/H Income for Greater Sydney |

50-80% of Gross Median H/H Income for Greater Sydney |

80%-120% of Gross Median H/H Income for Greater Sydney |

|

Income Range (2) |

<$783 per week |

$784-$1,253 per week |

$1,253-$1,879 per week |

|

Affordable Rental Benchmarks (3) |

<$235 per week |

$236-$376 per week |

$377-$564 per week |

|

Affordable Purchase Benchmarks (4) |

<$228,000 |

$228,001- $364,000 |

$364,001- $545,000 |

Source: JSA 2016, based on data from ABS (2011) Census indexed to March Quarter 2016 dollars

(1) All values reported are in March Quarter 2016 dollars

(2) Total weekly household income

(3) Calculated as 30% of total household income

(4) Calculated using ANZ Loan Repayment Calculator, using 4 January 2016 interest rate (5.37%) and assuming a 20% deposit for a 30 year ANZ Standard Variable Home Loan and 30% of total household income as repayments.

1.3 Why does affordable housing matter?

There is a common misconception that ‘affordable housing’ refers only to social (public or community) housing. However, many current and future residents facing affordability problems in the Inner West Council area are likely to fall outside the eligibility criteria for such housing.

This includes a young person seeking to live near where they grew up, a recently separated or divorced person with children for whom conventional home ownership may no longer be economically viable, households dependent on one (or even two) low or median waged, key worker jobs, or an older person on a reduced retirement income.

Lack of affordable housing not only affects the quality of life of individual families, who may be sacrificing basic necessities to pay for their housing. It also has a serious impact on employment growth and economic development. The loss of young families and workers in lower paid essential service jobs can adversely affect local economies, and is contributing to labour shortages in some areas of metropolitan Sydney.

This can contribute to a lack of labour supply among ‘key workers’ who are essential to various services including childcare, aged services, health care, tourism, hospitality and emergency services, but whose wage increasingly does not allow them to access rental or purchase housing close to where they work. Affordably priced housing is thus an important form of community infrastructure that supports community wellbeing and social and economic sustainability, including a diverse labour market and economy, and strong and inclusive communities. Despite this, the most compelling need for affordable housing remains with very and low income renters.

Finally, the location of affordable housing is a key issue in terms of social equity and sustainability. Providing for a mix of affordable housing for different target groups in well-located areas provides for social mix and reduces the potential stigma that can be associated with such accommodation. Locating such housing close to transport and services also provides for the needs of key groups including those with a disability and the frail aged, reduces car dependency and the cost of transport, which can be a significant impost on very low, low and moderate income households[2] and on the environment.

1.4 Gentrification and Social Exclusion

The ongoing loss and non-replacement of affordable housing through gentrification and redevelopment, and the current and projected degree of unmet housing need in the Inner West Council area provides a strong rationale for intervention in the housing market through the planning system.

The analysis of key socio-economic indicators provides clear evidence of significant demographic change, rapid gentrification and displacement and exclusion of more disadvantaged and vulnerable people from the Inner West Council area over at least the past decade in the former Marrickville and Ashfield LGAs, and for at least two decades in the case of Leichhardt LGA; and the failure of the market to provide for the needs of very low, low and moderate income key workers and other more vulnerable groups in an increasingly expensive housing market.

The more recent gentrification of areas like Sydenham-Tempe-St Peters, Ashfield and Dulwich Hill-Lewisham, and the longer-term displacement of more disadvantaged people from areas like Newtown, Petersham and Balmain, are particularly evident from the research that supports this Policy. The loss of very low income households in the Inner West LGA was four times greater than that for Greater Sydney from 2001-11, with the former Leichhardt LGA experiencing the greatest proportional losses of lower income households. Overall, the former Marrickville LGA has experienced the most rapid gentrification in recent years, although the former Leichardt is the most ‘gentrified’ in terms of income, education and occupational status of its residents, having experienced major social change over a far longer timeframe. The ongoing loss of lower income and younger key workers is an issue across the LGA.

The very high rate of housing stress among very low and low income households is also a key consideration, in particular the increasing rates of housing stress over the past decade among low and moderate income households in suburbs that were once more affordable. Together with mobility data, which shows the movement of lower income households and lower status workers out of the LGA in search of more affordable housing, the high rate of homelessness and the relatively low rate of social housing (3.5% in the Inner West LGA compared with 5% for Greater Sydney), provides a compelling rationale for intervening in the market to create affordable housing through the planning system.

1.5 Current Lack of Affordable Housing

The market is not providing affordable housing for the vast majority of very low, low and moderate income households who need it in the Inner West Council area, and is not replacing existing stock of housing that is affordable to these groups as it lost through gentrification and redevelopment.

Virtually no strata products (the lowest cost form of accommodation) are affordable for purchase through the market for very low, low and moderate income households anywhere in the LGA. At best, some small strata products in cheaper areas may be affordable to the very top of the moderate income band. No houses or two or three bedroom strata dwellings are affordable to any very low, low or moderate income households, so that families with children are entirely excluded from affordable purchase in the LGA.

The vast majority of households needing affordable rental housing in the LGA are also excluded from affordable rental through the market. The only affordable option for very low income households are lower amenity boarding house rooms in a few suburbs; while low income renters can only affordably rent a studio or one bedroom apartment in a few suburbs. Moderate income renters can affordably rent a two bedroom apartment in some suburbs, and so are somewhat better catered for, but again family households with children are excluded from larger housing options.

Given that the cost of new build products are likely to reflect the third quartile of existing products, and that there have been significant increases in housing cost in real terms in recent years, it is likely that housing will become even more unaffordable in the LGA in the future.

The evidence indicates that the vast majority of those needing affordable purchase and rental housing in the LGA are unlikely to have their needs met through the market without strong planning intervention to create affordable housing.

1.6 Likely Future Lack of Housing Affordability

Section 3.3 of Council’s Affordable Housing Background Report (JSA 2016) provides an analysis of how likely it is that the market could provide affordable housing in the future, and what planning interventions through the market would most likely be effective in this regard.

Importantly, the analysis indicates that it is unlikely that any separate house will be affordable in the Inner West Council area in the future, and in any case, there are limited development opportunities for such products, with the best predictor of the price of strata dwellings being the strata area from the linear regression analysis (see Table 3.2 in Council’s Affordable Housing Background Report (JSA 2016) for detailed analysis).

However, even under more optimistic scenarios (in particular, reduced strata area, parking and one bathroom), modelling indicates that, even with planning intervention to encourage or mandate such dwellings, all very low income and low income households are likely to be excluded from affordable purchase in the Inner West LGA in the future. Given recent real increases in rents, and the relationship between rates of return on purchase costs and rents charged, the situation for very low, low and moderate income renters is expected to worsen in the future.

Moderate income households would have somewhat more choice in relation to the affordability of studio and smaller one bedroom apartments, and boarding house accommodation, but again most of this income group including moderate income families would be excluded from affordable purchase in the future.

Nonetheless, specifying a proportion of minimum sized studio, one bedroom and two bedroom apartments without parking in multi dwelling housing and apartment developments is likely to provide affordable purchase accommodation in some suburbs, and will provide lower cost purchase accommodation in other areas. As around 60% of privately occupied apartments enter the private rental market,[3] such stock is likely to add to the stock of affordable and lower cost rental accommodation.

Stronger intervention

through the planning system in the form of mechanisms to capture an equitable

share of land value uplift, as well as the direct creation of affordable

housing on public land through development partnerships, is likely to be

required to achieve affordability for the vast majority of relevant target

groups, in particular all very low and low income households, and moderate

income family households.

1.7 Rationale for Capturing Land Value Increment through Relevant Planning Mechanisms

As noted, there is clear justification for Council to actively seek to increase the supply of affordable housing through its planning powers based on housing need, loss and non-replacement of affordable housing, and the failure of the market to provide such housing in the local housing market context.

Increased competition for land and housing resources through household formation, demographic change and in-migration of wealthier groups will continue to exacerbate affordable housing need in the future. As with the need for other infrastructure and public amenities and services arising from re/development, continued pressure will lead to increased housing stress and displacement of very low, low and moderate income workers and residents in the future.

An opportunity to create affordable housing exists through the proper use of Council’s planning powers under the NSW Environmental Planning and Assessment Act 1979 (the Act). In particular, the capture of a reasonable and equitable share of land value uplift created through the planning and development approval process is justified in the local housing market context.

A relevant definition of land value capture is provided by Taylor (2016) in the NSW planning context, that is,

In the broadest terms, [land] value capture in relation to urban land development involves a planning authority, such as local council in NSW, capturing for the community benefit some of the land value increase accruing to a parcel of land from planning activities of the authority which increase the development potential of the land and hence its value.[4]

Two broad approaches to land value capture are relevant to this policy, these being, ‘approaches intended to recover the cost of infrastructure investments and broader approaches intended to capture some share of the unearned increment in private land values [emphasis added], with the first exemplified by s94 approaches that seek to internalise the costs or impacts of the development; and the second found in mechanisms such as voluntary planning agreements under s93F of the Act, and variations to controls under clause 4.6 applications, which seek to capture a reasonable share of uplift.

It is important to note that land value capture arising from government planning actions, and in the way in which it is implemented in this policy, is not a form of taxation. Rather, the fundamental purpose of value capture is to clawback, or to gain a reasonable share, of the increased land value on the basis of a legitimate claim by the planning authority to share the ‘unearned increment’ of land value uplift that results from its planning actions for use by the community as a public purpose.[5] Depending on the relative scarcity of land, and considerations of amenity around the land rezoned, the increase in value may be greater or lesser.

While, in a free market, economics would predict that the profit would be a ‘normal profit’ (generally considered as 10%[6]), the supply of residential land does not operate within a free market. Supply is essentially rationed, firstly, by the planning process, and secondly, by the timed release of land by developers to maximise profit. As a result, the actual profit may be well in excess of normal levels of profit or private benefit, and must be calculated within each local market or submarket context.

1.8 Key Considerations in Land Value Capture

Key considerations for implementing value capture schemes, which could be considered as best practice in the development of this policy,[7] include the following:

· Justification – where the planning authority has or will increase the value of land through its actions, and the community is entitled to a share of the resulting uplift;

· Entitlement – the proper objective of which is to identifying the unearned increment in land value uplift resulting from any planning proposal and to decide the community’s legitimate claim to a share of it;

· Calculation - how the land value increase should be calculated for value capture purposes, noting that a residual land value analysis should generally apply;

· Development feasibility – that the implementation of value capture should not adversely impact on development feasibility by denying the developer a reasonable share of development profit;

· Timing - in consideration of reasonableness and equity, the value capture requirement should apply to land acquired for redevelopment after a nominated date related to the implementation of the policy.

1.9 Council’s Obligations, Opportunities and Constraints under Relevant Legislation

Appendix A of Council’s Best Practice in Value Capture Position Paper (JSA 2016) sets out a review of the legislative obligations, opportunities and constraints for local government in the creation of affordable housing through the planning system.

As noted, Council has an obligation to actively engage with affordable housing, including in accordance with Object 5(a)(viii) of the Environmental Planning and Assessment Act 1979 (NSW) – ‘the maintenance and provision of affordable housing.’

There are two main mechanisms that can legitimately be used to capture a reasonable proportion of uplift from planning actions in the NSW planning context.

· Council can legally enter into voluntary planning agreements that include the dedication of land free of cost, the payment of a monetary contribution, or provision of any other material public benefit, or any combination of these, to be used for or applied towards a public purpose, including ‘affordable housing’ under s93F of the Act, noting that nexus requirements do not apply. Such planning agreements can be made, for example, with respect to the capture of a reasonable share of additional land value that has resulted from a proposal to rezone or otherwise vary planning controls that would normally apply to a site or within a precinct under planning proposals and applications for clause 4.6 variations.

The use of this mechanism would require a transparent policy including method of calculation, areas to which it applies, collection and accountability mechanisms, etc, and would also likely need to be set out in detail in amendments to Council’s existing Planning Agreements Policy, noting that such proposals would need to demonstrate merit in their own right;

· Alternately, or in addition, Council can seek State Government approval for Council (or the State Government) to levy a contribution toward affordable housing under s94F of the Act where there is a major up-zoning or rezoning under the LEP, given the demonstrated need for affordable housing in the LGA. The use of this mechanism would require ministerial approval for either:

o An amendment to SEPP 70 (Affordable Housing), as well as relevant amendments to Council’s LEP, which would need to set out the geographic areas of inclusion, the quantum and basis of calculations, etc, like those in City of Sydney and Willoughby LEPs (noting that this has now been supported in the GSC’s Central District Plan); or

o The development of a special contributions plan by the State Government like that developed in relation to the Redfern Waterloo Authority Affordable Housing Contributions Plan 2006. This would require legislative support, noting that such support is provided in the case of Redfern Waterloo under s30 of the Redfern-Waterloo Authority Act 2004 (see Appendix A of Council’s Affordable Housing Background Report (JSA 2016) for detail).

1.10 Reasonableness and Feasibility of Mechanisms

The evidence provided in background reports to this Policy indicates that Council is justified in seeking to capture a share of unearned land value uplift arising from the planning and development approvals process in the LGA; and that it is reasonable to do so due to the nature and severity of unmet affordable housing need arising from ongoing gentrification and redevelopment, and the failure of the market to replace such housing or to provide for the needs of most very low, low and moderate income households.

Evidence reported in Section 4 of the Affordable Housing Background Paper (JSA 2016), and Section 7 of the Position Paper: Best Practice in Value Capture (JSA 2016) also indicates that the implementation of value capture through the method of calculation described in this policy will not adversely impact on development feasibility, and takes into account normal development profit.

The modelling provides evidence of significant value uplift associated with redevelopment of existing industrial land and housing for higher density development throughout the LGA, including value uplift associated with up-zoning of the three relevant precincts within the Sydenham to Bankstown Urban Renewal Corridor and precincts within the Parramatta Road Urban Transformation Area. It also provides evidence of significant uplift associated with variations to planning controls within a number of areas of the LGA.

As such, the Policy provides for a 15% Affordable Housing Contribution within new release areas, brownfield and infill sites, and major private and public redevelopments, including on State Government land and in State urban renewal projects, including precincts within the Parramatta Rd Urban Transformation Area and the Sydenham to Bankstown Urban Renewal Corridor that are within the Inner West Council area. The Policy will apply to such land that is subject to rezoning or amendment to planning controls that provide for increased density. Further, the Policy will apply to proposed developments comprised of 20 or more dwellings or that have a Gross Floor Area of 1,700m2 or greater across the LGA.

Modelling and research indicates that the most likely areas that will experience redevelopment will be older industrial areas and areas of lower quality commercial development, and that developments will generally be able to sustain a 15% levy without adversely affecting redevelopment. However, economic modelling also shows that some types of redevelopment may be adversely affected by a 15% levy, for example, mid-rise development on smaller lots. Therefore, a threshold of 20 units, or 1,700m2 Gross Floor Area[8] has been selected as a development that is of sufficient scale to generally avoid such development disincentives.[9]

Further, although a minority of precincts modelled may face redevelopment constraints currently, the rapid increase in land values in recent years indicates that areas that are not as feasible are likely to become so within a reasonable timeframe.

These findings provide a strong justification for value capture associated with incentive-based or voluntary planning agreement approaches in association with redevelopment, as well as for mandatory contributions or inclusionary zoning across the LGA, including in urban renewal precincts. Further analysis provided at Section 8 of Position Paper: Best Practice in Value Capture (JSA 2016) and Section 5 of the Background Paper (JSA 2016) also indicates that development feasibility will generally not be affected by the implementation of this Policy.

2

PART B: HOUSING POLICY

2.1 Housing Goal

The overarching goal of Council’s Affordable Housing Policy is:

To facilitate the provision of affordable housing options within the Inner West Council area to meet the needs of very low, low and moderate income households so as to promote diversity, equity, liveability and sustainability.

2.2 Affordable Housing Definition

In accordance with the statutory definition under the NSW Environmental Planning and Assessment Act 1979 (NSW), Table 2-1 provides benchmarks that are used in this policy when referring to ‘affordable housing’. These will be indexed quarterly and as Census data becomes available.

· Table 2.1: Affordable Housing Income and Cost Benchmarks

|

|

Very low-income household |

Low-income household |

Moderate-income household |

|

Income Benchmark |

<50% of Gross Median H/H Income for Greater Sydney |

50-80% of Gross Median H/H Income for Greater Sydney |

80%-120% of Gross Median H/H Income for Greater Sydney |

|

Income Range (2) |

<$783 per week |

$784-$1,253 per week |

$1,253-$1,879 per week |

|

Affordable Rental Benchmarks (3) |

<$235 per week |

$236-$376 per week |

$377-$564 per week |

|

Affordable Purchase Benchmarks (4) |

<$228,000 |

$228,001- $364,000 |

$364,001- $545,000 |

Source: JSA 2016, based on data from ABS (2011) Census indexed to March Quarter 2016 dollars

(1) All values reported are in March Quarter 2016 dollars

(2) Total weekly household income

(3) Calculated as 30% of total household income

(4) Calculated

using ANZ Loan Repayment Calculator, using 4 January 2016 interest rate (5.37%)

and assuming a 20% deposit for a 30 year ANZ Standard Variable Home Loan and

30% of total household income as repayments.

2.3 Target Groups

Council is committed to protecting and increasing the supply of housing stock that can be affordably rented or purchased by very low, low, and moderate income households, including target groups identified as having particular housing needs in the Inner West Council area. These include:

· Very low and low income renting households;

· Very low, low and moderate income key workers;

· Asset poor older people, including long-term residents of the LGA;

· Young people, including those with a social or economic association with the LGA;

· Lower income families including sole parent families and those totally priced out of the housing market;

· People with special housing or access needs, including people with a disability, frail aged people, those at risk of homelessness, Aboriginal and Torres Strait Islanders and people from culturally and linguistically diverse communities.

2.4 Priority Strategies

Constituent councils of Inner West Council have set out a range of affordable housing priority strategies to ensure that the LGA provides affordable housing options to meet the needs of the community.[10] Broadly, these include:

1. To research and develop strategies to increase affordable housing supply;

2. To encourage the provision of affordable, adaptable and diverse housing for very low, low and moderate income households, including those with special housing and access needs;

3. To pursue planning controls that support existing and new supplies of affordable housing;

4. To advocate for, and build partnerships to increase, affordable and liveable housing;

5. To resist the loss of affordable housing and encourage the retention of existing affordable housing to maintain the socio-economic diversity within the LGA;

6. To support people living in residential care and boarding houses and ensure boarding houses provide clean and healthy living environments;

7. To raise awareness of affordable housing needs and issues to facilitate action.

Although each of these priority strategies is important, the focus of this Policy is on Priority Strategies 1 to 4 due to evidence that suggests that these will be by far the most effective strategies in the local housing market context.

2.5 Pursue Planning Controls that Support Existing and New Supplies of Affordable Housing

2.5.1 Market Delivery of Affordable Housing

Noting the evidence that the strata area of apartments is a relevant factor in cost, and in affordability for some of the target groups, for developments of ten or more apartments, Council will require 5% of apartments to be delivered as studio apartments with total strata area (including parking) less than 36 square metres, 5% of apartments to be delivered as one bedroom apartments with total strata area (including parking) less than 51 square metres, and 5% of apartments to be delivered as two bedroom apartments with total strata area (including parking) less than 71 square metres, with calculated numbers of apartments rounded up to the nearest whole number.[11]

Council will also facilitate the provision of lower cost and more affordable dwellings through ensuring that its planning controls do not unreasonably constrain the supply of genuinely affordable housing, including through provisions that encourage the development of larger, higher cost dwellings, constraints on lower cost housing types such as appropriately located secondary dwellings and other dwellings that can make a demonstrated contribution to affordable housing.

2.5.2 Sharing Land Value Uplift for Affordable Rental Housing

Achieving an Equitable Share of Land Value Uplift

Noting the evidence from the research that very little affordable housing will, in reality, be provided through the market in most areas of the LGA, Council will seek to gain an equitable share of the land value uplift resulting from its planning actions, including major development applications, rezonings and variations to planning controls that would otherwise apply to a site or precinct, for the benefit of the community as Affordable Rental Housing.

Council will use mechanisms available to it, including voluntary planning agreements under s93F of the Environmental Planning and Assessment Act 1979 (NSW).

In accordance with key directions in the Greater Sydney Commission’s Central District Plan, Council will seek amendments to SEPP 70 — Affordable Housing (Revised Schemes), and make relevant amendments to its LEP, to enable the levying of Mandatory Development Contributions to create Affordable Rental Housing in perpetuity.[12]

Regardless of the mechanism used, Council will seek to apply equitable, reasonable, transparent and feasible contributions to affordable housing within the local housing market context.

In entering into such land value uplift sharing arrangements, Council will apply the following principles:

· Justification – where the planning authority has or will increased the value of land through its actions, and the community is entitled to a share of the resulting uplift;

· Entitlement – the proper objective of which is to identifying the unearned increment in land value uplift resulting from any planning proposal and to decide the community’s legitimate claim to a share of it;

· Calculation - how the land value increase should be calculated for value capture purposes, noting that a residual land value analysis should generally apply;

· Development feasibility – that the implementation of value capture should not adversely impact on development feasibility by denying the developer a reasonable share of development profit;

· Timing - in consideration of reasonableness and equity, the value capture requirement should apply to land acquired for redevelopment after a nominated date related to the implementation of the policy.

Voluntary Planning Agreements under 93F of the Act

Proposals to which this Provision Applies

When considering planning actions that result in an increase in residential and/or commercial floor area, Council will seek an equitable share of the land value uplift through a planning agreement under s93F of the Act.

Planning agreements will be classified as either:

· Marginal Planning Agreements, that is, a planning agreement made in relation to variations to existing controls, for example, a proposal for additional height or FSR under clause 4.6 of the LEP or ‘density bonus’ schemes; or

· Major Planning Agreements, that is, a planning agreement made in the case of a proposed rezoning or amendment to planning controls that will allow for additional density within a site or precinct. Mandatory Contributions will apply to all new release areas, brownfield and infill sites, and major private and public redevelopments, including on State Government land and in State urban renewal projects, including precincts within the Parramatta Rd Urban Transformation Area and the Sydenham to Bankstown Urban Renewal Corridor that are within the Inner West Council area. The Policy will apply to proposed developments comprised of 20 or more dwellings or that have a Gross Floor Area of 1,700m2 or greater.

Method of Calculation

Marginal Planning Agreements

In the case of Marginal Planning Agreements, marginal gross floor area will be taken as the additional gross floor area available to the developer as a result of the planning action, compared to the area available without the planning action. Land is excluded from the calculation as the land value is assumed to be amortised within the existing planning controls.

The Council share of land value uplift will be taken as a share of the marginal gross floor area as shown as LVC% in Table A1 of Appendix A of this Study for the appropriate postcode area (see also Sections 7.2.2 and 8 of Council’s Value Capture Position Paper, and Sections 4.2, 4.3 and 5 of Council’s Affordable Housing Policy: Background Paper for method of calculation and underlying assumptions).

Generally, where a Marginal Planning Agreement results in an increase in saleable floor area, land value capture of 21% to 34% of the additional saleable floor area obtained as a result of the Planning Agreement is warranted with regard to the evidence in the supporting studies.

Major Planning Agreements

In the interest of consistency and transparency, Council will apply a consistent share of land value uplift across the Inner West LGA to create Affordable Rental Housing in perpetuity.